While many banks still offer pitiful returns, savvy savers are earning 5x more by switching institutions. High rates aren't just pain—they're an opportunity that most Americans are missing. Here's how to profit from the shift.

Those "easy" payment plans are becoming a financial trap. Late fees hit hundreds for being just two days late, while 60% of Americans juggle multiple BNPL payments—often missing the hidden costs until it's too late.

Those "free" deals are costing Americans billions. From forgotten trial subscriptions to loyalty programs that drive overspending, zero-dollar offers are the most expensive marketing trap in your budget. Here's how they get you.

Invisible money vampires are silently draining your bank account. Discover the nine shocking financial traps costing you thousands—and how to stop bleeding cash without sacrificing your lifestyle.

Tired of money-saving advice that feels like punishment? Discover 14 sneaky strategies to build wealth without sacrificing your lifestyle—and stop leaving thousands on the table.

Think smart homes are just fancy gadgets? They're money machines. The average household wastes $600 yearly on phantom energy and outdated systems. Here's how to stop hemorrhaging cash through inefficient tech.

Explore how the average household unknowingly spends over $3,000 a year on subscriptions. Learn to conduct a subscription audit and implement strategic spending to regain control of your finances without sacrificing enjoyment. Discover the art of mindful financial choices in today’s subscription-driven economy.

Silent money-killers are bleeding you dry—$5,000+ vanishing without a trace. Discover the sneaky expenses destroying your financial future before it's too late.

You're bleeding money without knowing it. These 11 sneaky expenses are silently draining your bank account—costing you thousands each year that you'll never get back.

While retail giants scramble to survive, savvy shoppers are flipping the script. Discover how price manipulation tactics waste your money—and the strategic shifts that transform shopping from retail therapy to wealth building.

Think you're spending $100 on subscriptions? The real number is likely 2.5 times higher. The average household burns $3,300 annually on forgotten subscriptions while companies bank on your subscription blindness.

Retailers are secretly draining your wallet through psychological tricks. Discover 11 stealth strategies that expose their manipulation and help you save thousands without sacrificing your lifestyle.

Silent money vampires are bleeding your bank account dry—costing you thousands without you even noticing. Discover the 9 hidden leaks that are quietly destroying your financial future.

The average household hemorrhages $3,000 annually on subscriptions while using less than half. Companies weaponize psychology and "small" monthly fees to mask a steadily growing financial drain.

Impulse purchases have doubled to $214 since 2020, as Americans cope with stress through shopping. While retailers profit from our emotional spending, smart strategies can protect both lifestyle and savings—without going cold turkey.

Discover nine sneaky home expenses silently draining your bank account, from smart home subscriptions to energy vampires. Learn how to plug these financial leaks and reclaim $2,000-$5,000 annually without sacrificing comfort. Your home can be a sanctuary, not a money pit!

Discover 13 sneaky tactics retailers use to drain your wallet, from decoy pricing to shrinkflation. Learn how to combat these hidden costs, implement practical strategies, and regain control over your spending. Your financial awareness is your best defense against these clever traps!

The average household bleeds $219 monthly on subscriptions—while underestimating that cost by $100. From forgotten fitness apps to dormant streaming services, your autopay settings are silently sabotaging your savings.

Beyond the $1,000 monthly price tags, weight loss drugs expose a deeper crisis in prescription costs. But smart patients are discovering hidden savings programs and negotiation tactics that slash medical expenses by up to 80%.

Silent money drains are bleeding you dry—costing thousands without you even noticing. Discover the sneaky expenses robbing your financial freedom before it's too late.

Bleeding money without realizing it? These 10 sneaky financial vampires are silently draining your bank account—and you're probably overlooking every single one of them.

While headlines scream market chaos, smart investors are quietly building fortress portfolios. Discover how systematic investing beats emotional trading—and why complex strategies often backfire when simplicity wins.

The average household burns $273 monthly on subscriptions—most without realizing it. That "harmless" $10 monthly fee? It's silently draining $600 from your wealth over five years. Here's how to stop the bleeding.

Silent money vampires are bleeding your wallet dry. Discover the 14 sneaky expenses stealing thousands annually—and how to plug these devastating financial leaks before it's too late.

Nine painless wealth-building strategies that help grow fortune while enjoying life's pleasures.

Those small convenience purchases aren't just pocket change—they're costing Americans $3,500 annually in hidden markups. Discover how delivery apps, subscriptions, and "time-saving" services are secretly sabotaging your wealth.

Mental exhaustion isn't just making you tired—it's bleeding your bank account. With 35,000 daily decisions draining willpower, evening impulse purchases spike 70%. Learn how decision fatigue silently sabotages smart spending.

Are invisible money leaks silently draining your bank account? Discover 9 shocking household expenses costing you thousands—and how to plug them with zero lifestyle sacrifice.

Silent money vampires are bleeding your bank account dry. Discover the 13 sneaky expenses costing you thousands—and how to plug these financial leaks instantly.

Those glittering casino lights mask a cold mathematical truth: 98% of gamblers lose. Learn the psychology casinos use to empty your wallet, and the non-negotiable rules smart players follow to protect their cash.

Think those "small" monthly subscriptions are no big deal? The average household juggles 12 recurring payments, silently draining over $2,000 annually. Here's how to stop the subscription creep.

Silently bleeding money? Discover the 14 hidden financial traps draining your bank account without you even noticing—and how to stop losing thousands every year.

Retailers have a secret playbook designed to empty your wallet. Discover the nine mind-bending tricks stores use to make you spend money you never intended—and how to fight back.

Think you're just paying for Netflix? The average household now hemorrhages $3,300 yearly on subscriptions—double what we spent in 2020. Those "small" monthly fees are silently sabotaging your savings.

Discover how hidden bank fees are draining your finances and learn strategies to fight back. This article reveals ways to avoid unnecessary charges, switch to better banking options, and reclaim your hard-earned money for the things that truly matter.

Silently bleeding money? Discover the 11 hidden financial traps draining your bank account—and the simple fixes that could save you thousands without sacrificing your lifestyle.

Desperate to stop the financial bleeding? Discover the 14 sneaky money traps silently draining your bank account—and how to reclaim thousands without sacrificing your lifestyle.

That brand loyalty? It's costing American households $5,000 yearly in hidden premiums. While corporations invest billions in emotional manipulation, identical alternatives sit right next to your favorite brands—at 30% less.

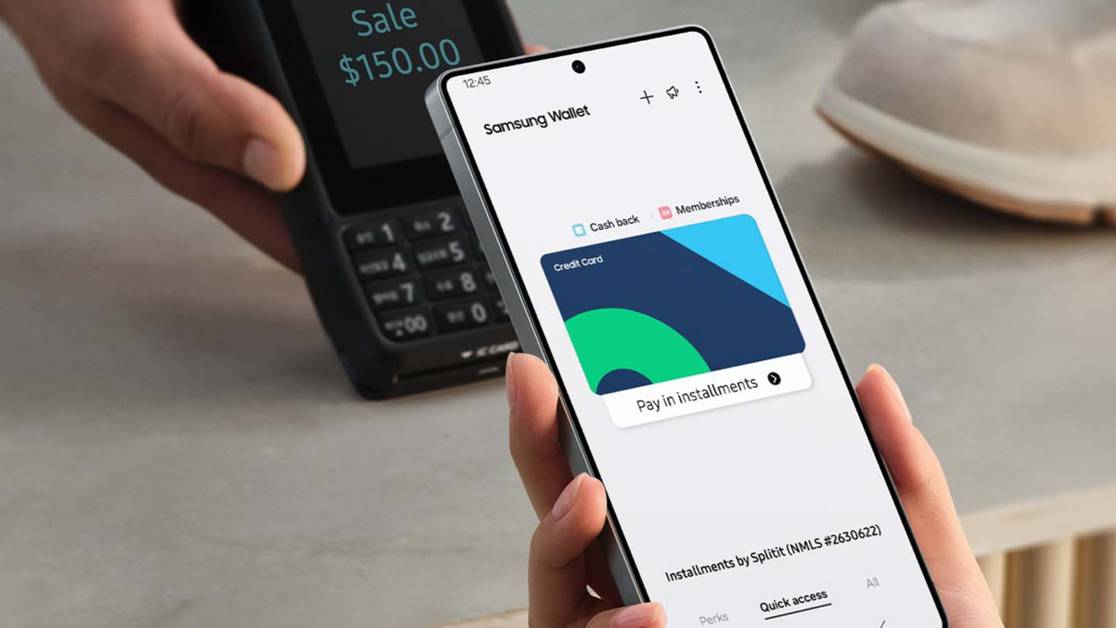

Digital payment scams don't require sophisticated hacking—just rushed decisions and basic mistakes. With billions lost annually, convenience is becoming a costly trap. Learn the new rules of digital money safety.

Grocery stores are secretly draining your wallet with psychological tricks. Discover nine insider strategies that could save you hundreds every month—before your bank account hits zero.

Tired of money-saving advice that feels like punishment? Discover 13 sneaky strategies to save hundreds monthly without sacrificing your lifestyle—no extreme budgeting required.

That harmless $15 monthly subscription? It's part of a $2,000+ annual drain hitting modern households. Most don't realize how these "small" conveniences compound into major money leaks. Here's how to plug the holes.

Think your home is financially efficient? Think again. The average household bleeds thousands yearly through invisible leaks—from mismanaged subscriptions to energy vampires. These silent wealth-drainers are hiding in plain sight.

Banks are secretly siphoning hundreds from your account through hidden fees. Discover the 14 sneaky charges draining your wallet—and exactly how to stop them cold.

Supermarkets engineer every detail—from layout to lighting—to boost your spending by 41%. Learn the insider psychology tricks they use, and how to turn their own tactics against them to save big.

The average American wastes $273 monthly on subscriptions, with 84% underestimating their total spend by $100+. Those "small" monthly charges are silently draining thousands from your accounts each year.

Tired of drowning in money advice that never actually works? Discover 11 game-changing financial hacks that build wealth while you're Netflix-ing—without sacrificing your lifestyle.

Most households bleed $200-500 monthly on 8-12 subscriptions they barely use. Even worse? 84% underestimate these costs by $100+. Here's how subscription services quietly drain your wealth—and how to stop the leak.

Airlines ban power banks; smart travelers save money with simple charging solutions instead.

Silently bleeding money? Discover the 9 sneaky financial vampires draining your bank account—and learn how to stop losing thousands without even realizing it.

Grocery stores are weaponizing psychology to drain your wallet. Learn the 11 mind games costing you thousands—and how to fight back before your next shopping trip.

Think your retirement savings are safe? Silent money drains like hidden fees and inefficient accounts are stealing thousands annually. A 0.5% fee difference alone could cost $100,000 over 30 years—and that's just the start.

Auto-pay isn't just convenient—it's a silent money drain. While companies bank on your "set it and forget it" mindset, the average American wastes $348 yearly on forgotten charges and missed negotiation opportunities.

Discover nine stealth wealth strategies that allow you to save without sacrificing your lifestyle. From smart automation of finances to setting boundaries with spending friends, these insights reveal how to build wealth effortlessly while enjoying life. Start your journey to financial freedom today!

Think your autopay bills are under control? The average household loses $500-850 annually to billing errors and stealth rate hikes. Most can't even estimate their monthly charges within $100.

The average household underestimates subscription spending by $250/month. Beyond streaming services, sneaky auto-renewals are draining bank accounts through professional tools, apps, and even household basics—creating a silent financial leak.

Silently bleeding cash? Discover the 11 sneaky money traps draining your bank account without you even noticing—and learn how to stop losing thousands each year.

Silent money traps are bleeding you dry. Discover the nine sneaky expenses costing you thousands—without you even noticing. Your wallet's emergency rescue starts here.

Don't let falling rates fool you. While some homeowners rush to refinance, the smartest money moves aren't obvious. Timing tricks and negotiation strategies can unlock thousands in hidden savings—or cost you big if mishandled.

Think those $9.99 subscriptions are harmless? The average household juggles 10 recurring services, silently draining over $2,000 annually. That's retirement money vanishing on autopilot—and most people don't even notice.

Tired of money-saving advice that feels like punishment? Discover 14 game-changing strategies that put thousands back in your pocket without sacrificing your lifestyle—no spreadsheets required.

Your money is silently bleeding out—9 hidden financial vampires are devouring thousands from your bank account every single year. Discover how to stop the leak.

The average household hemorrhages $3,276 yearly on subscriptions—with 84% of people underestimating their monthly costs by $100+. Those "small" charges aren't so small anymore.

Major banks are paying 0.01% while online accounts offer 4%+ interest. On $10,000, that's $400 yearly vanishing from your savings. Traditional banks bet you won't notice—or switch.

Silent money-suckers are stealing thousands from your wallet every year. Discover the 11 sneaky financial leaks bleeding your bank account dry—and how to stop them instantly.

Tired of money-saving tips that are either useless or impossible? Discover 14 real-world hacks that will save you thousands without making you miserable—no extreme frugality required.

The average household now bleeds $219 monthly on subscriptions—triple what they spent five years ago. From streaming to software, these silent money drains are engineered to stick and steadily increase, often unnoticed.

Those $10-15 convenience fees aren't just small charges anymore—they're silently draining $200-300 monthly from average households through subscriptions, delivery fees, and "premium" upgrades. Here's how to stop the bleeding.

Invisible money traps are silently draining your bank account. Discover the shocking ways you're losing up to $1,500 annually—without even realizing it.

Your home is silently bleeding you dry. Discover the 9 secret money drains costing you thousands—and how to plug them before they destroy your financial future.

The average household juggles 12 subscriptions, silently draining $3,600 annually. While companies exploit psychology to keep you subscribed, most people overlook 50% of recurring charges they don't even use.

That "cheap" Netflix subscription? It's part of a larger $1,596 annual drain most households don't see. Small monthly fees are silently stealing your wealth—and the real cost will shock you.

Your wallet is bleeding thousands without you knowing. Discover the hidden money leaks silently emptying your bank account—and learn how to stop the financial hemorrhage for good.

You're bleeding money without knowing it. Discover the 10 sneaky financial vampires silently draining your bank account—and how to stop them before it's too late.

The average household wastes $273 monthly on forgotten subscriptions. That's $3,276 yearly vanishing on autopilot—enough for a vacation or investment fund. Your "convenience" could be costing you financial freedom.

While Wall Street grabs headlines, the real money move is hiding in plain sight: High-yield accounts now pay 50x more than traditional banks. That's $500 vs $10 annually on a $10,000 emergency fund—crucial protection in today's uncertain market.

Tired of money-saving tips that feel like punishment? Discover 14 stealth strategies that can save you thousands without cutting a single thing you love—while outsmarting businesses that want to keep draining your wallet.

Digital subscriptions have surged 153% since 2019, with households juggling up to 12 services. Worse? 42% pay for ones they never use. Those $9.99 charges aren't so small anymore.

Your bank account is bleeding money—and you don't even know it. Discover nine sneaky financial leaks that are silently robbing you of thousands every single year.

Banks are silently stealing hundreds from your account through sneaky fees. Discover the 11 hidden charges draining your hard-earned money—and exactly how to stop them.

Think your $10 subscriptions are harmless? The average household now juggles up to 12 services, silently bleeding $3,400+ annually. Worse yet? You're probably using less than 35% of what you're paying for.

Think you're spending $100 on subscriptions? The real number is likely 2.5 times higher. From phantom fees to sneaky price hikes, modern conveniences are silently draining bank accounts—here's what's really happening.

Bleeding money without knowing it? These 11 sneaky financial vampires are silently draining thousands from your bank account—and most people have no clue they exist.

Your money is silently vanishing through hidden expenses—costing you thousands without you even noticing. This guide reveals the sneaky financial traps bleeding your bank account dry.

The average American silently loses $250 monthly to digital subscriptions—often paying twice for the same services. Learn how forgotten free trials and sneaky auto-renewals are draining your accounts, and how to stop the bleeding.

Modern convenience comes at a staggering price: $3,600 annually vanishing into delivery fees, subscriptions, and hidden markups. Behind every "easy" button lurks a financial trap most don't see until it's too late.

Your brain is betraying you: 9 sneaky psychological tricks that silently drain your wallet, costing you thousands without you even realizing it. Here's how to fight back.

Think you're spending $100 on subscriptions? Try doubling that. The average American bleeds $273 monthly on recurring charges—most hidden in plain sight. Here's how to spot the silent money drain before it's too late.

Invisible money vampires are draining your bank account right now. Discover 15 hidden financial traps costing you thousands—and learn exactly how to stop the bleeding.

Forget 3-month emergency funds—they're dangerously outdated. Today's layoff patterns demand a smarter safety net. Learn the new rules for building financial resilience without living like a recession is imminent.

Your kitchen is secretly stealing thousands from you each year. Discover the 11 sneaky ways you're bleeding money—and the brutally simple fixes that can save your financial future.

Silent money vampires are sucking you dry. Discover how sneaky expenses are robbing you of thousands each year—and exactly how to stop them dead in their tracks.

Think your "free" checking account is actually free? Those hidden fees are silently draining $250+ yearly from your account. From smart homes to loyalty programs, discover the invisible costs bleeding your budget dry.

Think you know where your money goes? The average household hemorrhages $219 monthly on subscriptions alone—yet most people estimate half that amount. These silent money drains are just the beginning.

Tired of money-saving advice that feels like punishment? Discover 11 sneaky strategies to save thousands without sacrificing your lifestyle—no extreme couponing required.

Retailers are secretly stealing your money using 9 mind-bending psychological tricks. Discover how they manipulate you—and learn exactly how to stop falling for their most devious spending traps.

The average household wastes $2,400 yearly on subscriptions—and 42% don't even remember what they're paying for. Here's how to stop the silent money drain without giving up services you actually use.

While banks and regulators debate reforms, sneaky fee hikes and service changes are quietly draining consumer accounts. Learn the insider moves to protect your money and turn industry shifts to your advantage.